LINE BK, the first Social Banking platform in Thailand, has revealed that the online financial transaction trend in Thailand is bursting through the world rankings, signalling the overall growth of the service in the first half of 2022. The number of LINE BK users has surpassed 4.7 million mark, with over 590,000 loan accounts, growing 81% Year on Year.

The AI system is also being developed in order to reach target customers widely and accurately, while managing the customers’ portfolio in terms of both quantity and quality. In the second half of the year, the planned partnership and transaction feature updates will better respond the needs of Thai customers along with the ‘Banking in Your Hand’ concept.

Tana Pothikamjorn, Chief Executive Officer of KASIKORN LINE reveals that, in the first half of 2022, LINE BK has continued to grow with 4.7 million users. Recently, TABInsights by The Asian Banker has announced the 2022 ranking of the Top 100 digital banks in the world where LINE BK is placed on the 44th spot overall and is the No.1 in Southeast Asia. The key that has supported the growth of LINE BK is Thai people’s wider acceptance in making digitally enabled payment transactions. In 2020, Thai people came first at making payment transactions via mobile banking (according to the Digital 2021 Global Overview Report). In 2021, there were over 9.7 billion real-time payment transactions in Thailand, ranking on the 3rd spot after India and China (source: ACI Worldwide, GlobalData and CEBR).

In June this year, LINE BK developed a system for KASIKORNBANK’s customers with K PLUS application to start using LINE BK more conveniently by merely linking their K PLUS account to LINE BK without having to register a new LINE BK account. Additionally, new features are being developed to improve user experience. At the end of the year, there will be debit card campaigns with many partners to offer special promotions for LINE BK users.

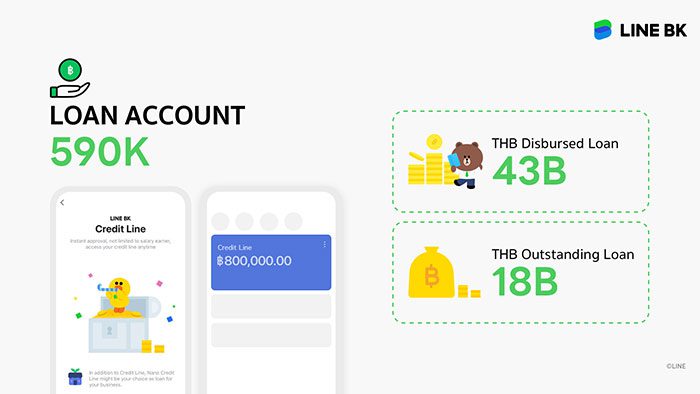

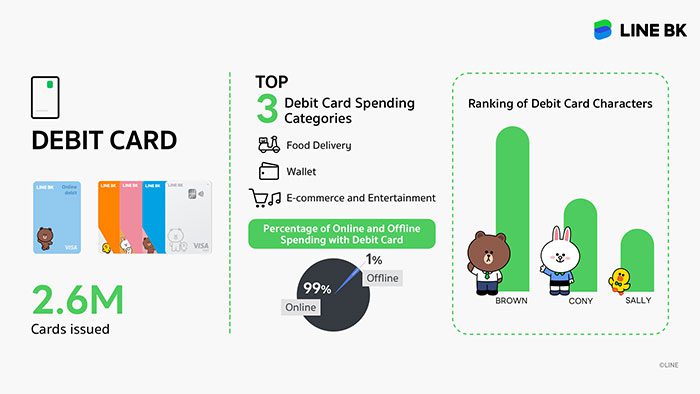

Statistical highlights in the first half of 2022:

- There are 5.6 million savings accounts, a 73% growth Year on Year, with a total of 78 billion baht transferred. LINE BK alerts were sent over 1.3 billion times. The top 3 most popular money envelopes or automatic payment slips with cute designs from LINE FRIENDS are the ‘Thank You’ envelope, ‘Love You’ envelope, and ‘Chinese New Year’ envelope.

- Over 150,000 special rate accounts have been opened, accounting for 95% growth Year on Year. The top 3 savings goals are for family, investments, and travel.

- A total of 2.6 million debit cards have been issued, achieving 93% growth Year on Year. Customers have made most payments in food delivery, wallet, e-commerce, and entertainment; 99% of these payments were made for products and services on online platforms. The most popular debit card design is BROWN.

LINE BK also offers 2 types of loan: Credit Line (Personal loan) and Nano Credit Line (Nano loan). Today, there are over 590,000 loan accounts, growing 81% Year on Year, with a total portfolio of more than 18 billion baht in outstanding loans while up to 43 billion baht of disbursed loan since the service was first launched. In the second half of the year, the company will continue to grow with quality and improve its system to screen customers more effectively.

Moreover, LINE BK is prepared to collaborate with other partners in the LINE Ecosystem and more to provide loan services to new customer bases to stimulate purchasing power and further business growth, while focusing on improving customer experience to offer seamless and convenient services to customers.

Furthermore, at the beginning of this year, LINE BK signed an agreement with Muang Thai Life Assurance PCL (MTL) to develop a channel to provide life and health insurance servicesvia LINE BK’s LINE Official Account. This is the first step as a broker in the insurance industry which will manifest fully in 2023, according to the business expansion plan.

“In the latter half of 2022, LINE BK is still committed to develop its services and expand its customer base. When it comes to opening accounts, making deposits, transfer, and withdrawal, and applying for debit cards, there will be updates and new features to continuously satisfy our growing base of customers.

For lending products, we are focusing on reaching customers across the country. The AI system is being developed to ensure more accurate data screening in order to reach customers who possess the need and readiness to apply for loans. We are also moving ahead with an insurance business and will be ready to launch as a broker fully next year. Another important strategy is to work with new partners to strengthen the business and increase opportunities to further different services to grow and better respond to customers’ needs. LINE BK believes that customer satisfaction is the key to a business’s stable growth in the future.” Tana concluded.