KBTG’s new technologies keep hands away from screens

The ‘New Normal’ way of life in Thailand is rapidly taking shape as the country emerges from the COVID-19 pandemic, with contactless technologies being introduced in transactions between people and businesses.

A leading technology company, Kasikorn Business-Technology Group (KBTG) – the IT arm of KASIKORNBANK – has launched a series of new contactless technologies for bill payments in response to an increasing trend towards digital spending.

KBTG Chairman Ruangroj Poonpol said the COVID-19 pandemic had obviously affected the lives of Thai people and the services using the new technologies were in step with the development of a ‘New Normal’ way of life.

The number of accounts opened via K PLUS has surged over the past three months, and the contactless technology is designed to play a pivotal role in helping to mitigate the spread of the coronavirus, he said.

The services are now available at the KBTG Building in Chaeng Watthana, and will be offered at Black Canyon outlets. The company plans to extend the service to other businesses in the future.

The six new contactless technologies include:

Face check-in: Facial scanning technology for authentication of identity, even if a customer is wearing a surgical mask. Moreover, in line with the ‘New Normal’ lifestyle, this technology will deliver an alert notification to a customer if he or she is not wearing a mask.

KLox: A locker service for customers, who can open and close lockers via contactless facial scanning. The service is now available at the K+ Building, Samyan.

Eat by Black Canyon: A payment-kiosk service jointly developed by KBTG and Black Canyon (Thailand). It aims to foster a ‘New Normal’ environment in Thai cafés and restaurants. The payment kiosk features a contactless menu system, which requires hand gestures for instructions, without the need to physically touch the screen.

Contactless Menu: A contactless food-order system via tablets, which can detect customers’ hand gestures as they give instructions.

Face Pay: A payment service via facial scanning for customers to confirm account debits. The service is fast and secure, needing only two simple steps.

ReKeep: A new digital-receipt service for stores. Customers can receive a digital receipt by scanning a QR Code, which helps to avoid touching. It also helps to mitigate climate change because it is paperless.

Ruangroj said KBTG’s innovative contactless technologies were developed to keep Thai people safe from the coronavirus contagion.

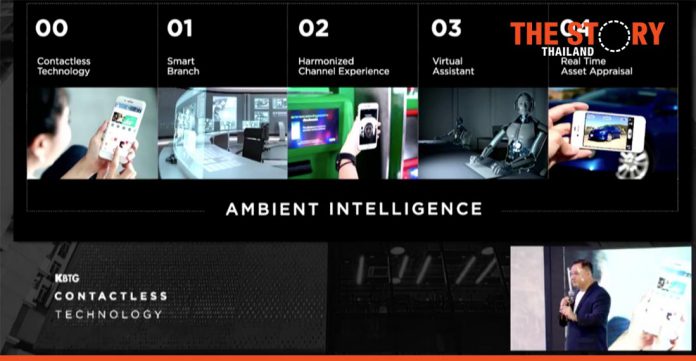

He said the initiative was launched alongside attempts to restore and reinvigorate business activity and economic potential. Adjustments are being made according to the concepts, visions, management styles and habits of various businesses. A start has been made with restaurants and the technologies will be carried forward into banking, with KASIKORNBANK set to embrace the status of the ‘Future of Banking’.

KBank is now prepared to expand its contactless technology in the near future to businesses in the entertainment, fashion and health industries. As time passes, the new contactless technologies will become familiar to us as they are integrated into everyday life and the ‘New Normal’ lifestyle becomes pervasive in Thai society, Ruangroj said.