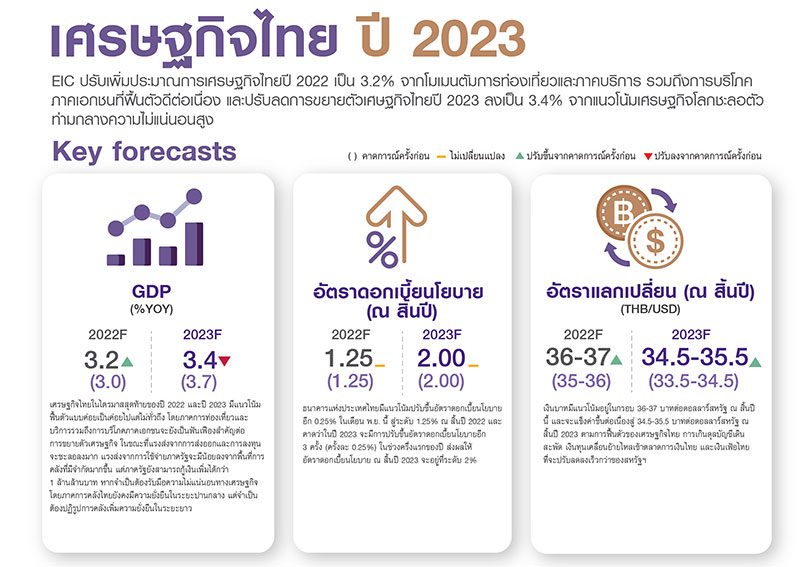

EIC revised up the Thai economic growth forecast to 3.2% (from the previous 3.0%) in 2022. An upward revision was attributed to a buoyant rebound in tourism and private consumption, following improvementsin tourism and related service sector as well as labor income.

However, the 2023 growth forecast is revised down to 3.4% (from 3.7%) since the signs of global economic slowdown became more apparent amidst rising uncertainties. Some major economies will soon enter a recession, and this would weigh down on Thai exports and investment ahead. Nonetheless, a solid rebound in tourism—thanks to the return of foreign arrivals—would provide significant support to Thailand’s economy in 2023.

EIC anticipated the return of 28.3 million tourist arrivals next year, considering high travel demand and China’s easing of the Zero-Covid policy. Domestic tourism also regained its pre-pandemic pace, thus adding impetus to tourism revenue, related service sectors, and domestic consumption. Despite upbeat outlook, Thailand would still witness an uneven rebound as some households and businesses remain fragile. Regarding inflation outlook, headline inflation would be gradually declined and lied above the target at 6.1% and 3.2% in 2022 and 2023, respectively. Inflationary pressures still remain high due to high energy and food prices that somehow embedded in core inflation.

Somprawin Manprasert, Ph.D., First Executive Vice President, Chief Economist of the Economic Intelligence Center (EIC), and Chief Strategy Officer at the Siam Commercial Bank PCL, stated that “We see a clearer sign of global economic slowdown this year and more to come in 2023, given rising uncertainties from elevated inflation, prolonged energy crisis, and synchronized monetary tightening worldwide. Some advaanced economies—such as the UK and EU countries—will head for a recession by late 2022, whereas the US might also witness in H2/23. EIC thus downgrades the global growth forecast from 3.0% to 2.9% in 2022 and from 2.7% to 1.8% in 2023.

In our base case, the global economy has yet to enter a recession since many countries would still record growth. For instance, China’s economy should make a steady rebound in line with the relaxation

of Zero-Covid policy. Nevertheless, unexpected circumstances—such as the escalation of international conflicts or inflation surges which prompt tighter monetary policy responses—might also push the global economy into a recession.”

He further added that “Globally, high inflation is here to stay despite the figures in some countries already passing its peak. In particular, EIC expects that major economies will expereince inflation outstripping the central bank’s targets for the next 1-2 years. This is because inflationary pressures start to entrench and service demand strengthens after demand for durable goods eventually rebalance to normal. Hence, major central banks would carry on a tight monetary policy into 2023—albeit with slower rate hikes—and keep policy rates high until inflation settles back within the target. Going forward, fiscal policy will shift focus from fiscal stimulus towards more fiscal sustainability, since the COVID-19 crisis left many countries with massive public debt piles.

Furthermore, given high uncertainties surrounding the global economy and monetary policy stance, global financial markets might face higher volatility and risks of market liquidity crunch alongside a tightening global financial condition. So far this year, risk-off sentiment took place resulting in a significant drop in risky asset prices worldwide. This would, in turn, hamper wealth effects and consumption ahead.”

Thitima Chucherd, Ph.D., Head of Economic and Financial Market Research of the Economic Intelligence Center (EIC), stated that “In EIC’s view, the Thai economy will witness a modest yet uneven rebound. The tourism sector and consumption are the key drivers, whilst impetus from exports and investment significantly subside. As living costs and business costs remained high, some households encoutered their expense exceeding income, whereas firms recovered on uneven ground. This was evident in an increase in the number of fragile households during the Covid-19 pandemic.

The figure stood at 2.1 million households or up 24% in two years. Businesses rebound unevenly. Firms that cater to demand from consumption recovery or align with the global trends were among the first to pick up. Meanwhile, some firms remained exposed to uncertainties and thus slowly recovered, given risks from global downturn and emerging mega trends.”

She also added that “There remain high uncertaines—from both domestic and external conditions—that overshadow Thailand’s growth outlook in 2023. In our base case, the recession is somewhat unlikely and the Thai economy should return to its growth potential by the end of 2024. Yet, if major central banks hike policy rates further by 100 bps above our base case in 2023—for instance, if the Fed raises its policy rate to 5.75-6.00%—this might trigger a global recession. In this gloomy scenario, the probability of Thai economy entering a recession next year will be greater than 80%. However, the government still secures enough policy room to cushion uncertainty to the Thai economy, yet the fiscal space has been narrowing since the aftermath of the COVID-19 crisis.

As for the monetary policy outlook, we expect the MPC to raise its policy rate gradually (by 25 bps in each meeting) to 1.25% at year-end 2022, followed by another three rate hikes to 2% in H1/23. Such gradual normalization approach would gear up the monetary policy stance in line with Thailand’s long-term economic growth path. Also, we believe the BOT will carefully adjust the pace of its policy rate hike to ensure that the policy normalization—both monetary policy and financial measures being gradually lifted next year—will not overly tighten financial condition and derail Thailand’s economic recovery in the wake of global economic slowdown and rising uncertainties.

Meanwhile, the Thai baht should continue strengthening until next year. The reason behind is that the US dollar tends to weaken as the Fed becomes increasingly dovish and the investor sentiment towards risky assets improves. In addition, the baht would gain impetus from Thailand’s economic recovery—backed by current account surplus that likely continues into 2023, capital inflows to the Thai financial market, and inflation which tends to slow down faster than the US reading. In consequence, EIC anticipates the baht to hover around 36-37 against the US dollar at year-end 2022, before appreciating to 34.5-35.5 baht/USD at year-end 2023.”

In her closing remark, Thitima emphasized that “Looking ahead, Thailand’s economy is still subject

to downside risks, namely: (1) Sharp slowdown in the global economy that could deter exports and investment, (2) Uncertainties over China’s Zero-Covid policy which affect both incoming Chinese tourists and Thai exports, (3) High inflation, interest rates, and debt that left fragile households and firms further delayed recovery, and lastly (4) Political uncertainty which that could dampen investor sentiment.”

‘Beyond the Elephant in the Room’- MIT Media Lab Southeast Asia Forum

KBank joins forces with four partners to unveil Dendo Drive House innovation