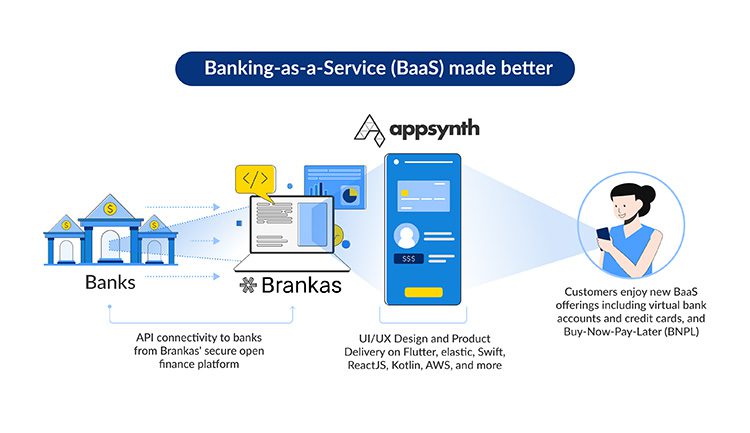

Brankas and Appsynth have announced an exclusive strategic partnership in Thailand to drive technology innovation in the financial services industry. The collaboration between Brankas’ cutting-edge financial technology platform and Appsynth’s expertise in mobile and web application development will help financial service businesses in emerging markets to accelerate the release of new open finance solutions.

About 70% of the population in Southeast Asia are underbanked and unbanked. Brankas is integrated with more than 100 enterprise partners to help emerging market consumers connect to the top banks and fintechs for e-wallet top-ups, loan and salary payments, and money transfers. Appsynth is Thailand’s leading digital innovation consultancy, creating successful digital products for market leaders including 7-Eleven, LINE, Sansiri, Honda, Rabbit and Kasikorn. The partnership is expected to facilitate fast and secure API connectivity to unlock banking-as-a-service offerings including virtual bank accounts and credit cards, instant payments at scale, additional eKYC methods, and Buy-Now-Pay-Later (BNPL).

According to Brankas, creating a banking-as-a-service solution with traditional tech and consulting firms can take at least one to two years because of the tedious infrastructure migration required. Brankas and Appsynth can now help reduce the time-to-market by at least 40% with their hybrid, cloud, or on-prem API infrastructure and out-of-the-box developer portal.

“There is a perception that slower is safer, which penalizes professionals and vendors that have developed more modern and efficient processes. With the rise of digital banks and fintechs, businesses that can reach customers before their competitors are the ones that gain the most market share,” said Sarah Huang, Regional Director of Sales, Brankas, adding that “Appsynth has consistently demonstrated the ability to create intuitive and impactful applications used by the masses, and we look forward to developing open finance solutions that enable anyone to have access to modern financial services.”

“Appsynth and Brankas are committed to creating a more connected, accessible, and user-centric financial ecosystem in Southeast Asia. Brankas’s open finance technology has been used in applications as diverse as telemedicine, tollways, e-wallets, and lending,” said Robert Gallagher, CEO, Appsynth. “Increasingly large consumer businesses are enhancing their core offering with complimentary financial services. Combining Appsynth and Brankas’ expertise will help clients and other financial institutions build embedded finance and banking-as-a-service solutions that deliver impact for both their customers and their business,” he added.

Brankas’ extensive market coverage in Southeast Asia will help Appsynth to expand its geographic reach to countries such as the Philippines and Indonesia.

Thai central bank, SEC work towards regulatory clarity for digital assets ecosystem